- Home

- Blog

- Get ready for the new act on digital cash registers and learn how you can get the most out of it with viva.com

Get ready for the new act on digital cash registers and learn how you can get the most out of it with viva.com

5 December 2023

From January 1st 2024, a new law will come into force requiring businesses in four different industries to have a digital cash register with automatic and digital sales registration. Read along below to be prepared to comply with the new rules and even optimise you business.

If you run a restaurant, nightclub, or a kiosk, it's not just festive New Year guests and hungover customers you have to deal with on the 1st January. 2024 will be the year in which 12,500 companies in Denmark will be subject to new rules in payments.

Going forward, businesses such as cafés, kiosks, pizzerias, restaurants, and pubs must have a digital checkout solution and digital sales registration. The purpose of the law is to reduce tax fraud by making it easier for SKAT to check whether undeclared work, VAT and tax is being cheated with.

If your company falls within the above categories and has a turnover of between DKK 50,000 and DKK mil. 10, the new legislation applies to you. In that case, read on below where we review what the new law means for your company and how you can ensure that your cash register complies with the new requirements.

Here are the requirements for your new checkout solution

In short, the new law requires your company to have a digital cash register where all sales and transactions are recorded and stored digitally in an online database. Your business' payment terminals must therefore communicate with the checkout system and support a number of technical requirements.

The cash register must be online so that all your sales and transaction data is recorded digitally, and you must use a receipt printer to print receipts instead of making handwritten receipts. At the same time, you must have a payment system that can print invoices and receive card payments, where the transaction is easily registered. In addition, there are requirements for daily updating of your bookkeeping and correct reconciliation.

You will find a complete list of all the requirements on SKAT's website here: New requirements for electronic sales registration systems for certain sectors in 2024 - Skat.dk

Your company bears the costs of any upgrade to a digital cash register and risks a fine of between DKK 10,000 and 30,000 from SKAT if it does not comply with the new rules.

Make the most of the new requirements with an improved payment solution

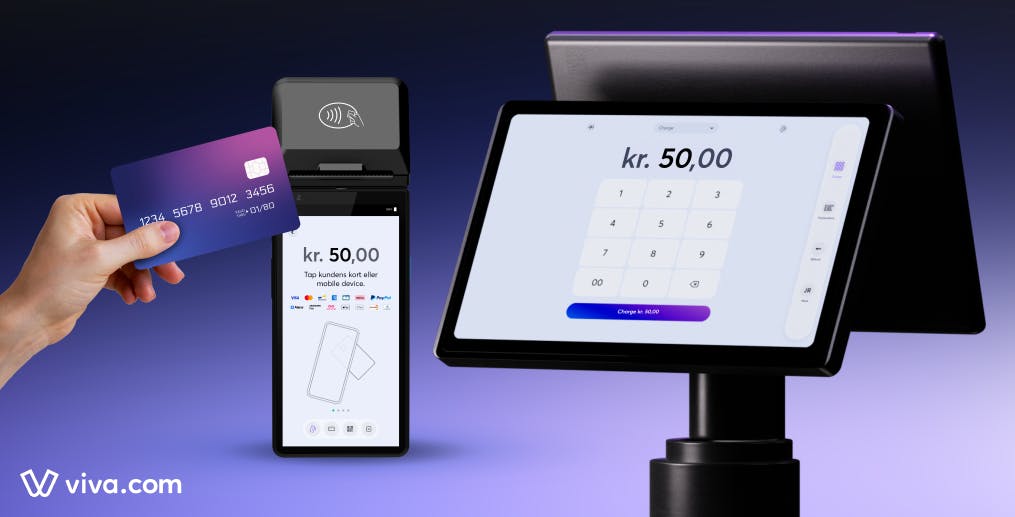

For many businesses, it simply requires an update of the terminal's software to be ready. This means that you do not necessarily need to replace the checkout system itself. If you use a payment solution from viva.com, which supports +985 different digital devices – including POS systems, tablets, card terminals, etc. – you can choose exactly the digital checkout system that suits your needs.

The new act provides several operational and economic advantages for businesses. With a payment solution from viva.com, you get access to your earnings immediately with the Real-Time Settlement feature, and you can pull sales reports in real-time and export your transaction history.

With the Offline Payments function, you can take payments even when the connection fails, and if you use viva.com's corporate card for your expenses, you can lower your transaction fees down to 0%. With all these benefits, you have the best opportunities to not only comply with the law, but to use your new digital checkout system to optimize your business and strengthen your bottom line.

Would you like a tailored solution?

If you need a new cash register system that meets the requirements, then we can help you get the best solution to optimize your business and strengthen your bottom line while compliant. Send an email to support@viva.com, and we’ll help you get started.